Serving a growing and vibrant community since 1941

People, community, technology and growth have all shaped our history, both as a credit union and as a region. Deeply rooted in the community and growing with it, BlueShore’s story is intertwined with those of the communities we serve.

Today, BlueShore Financial is one of the largest and most successful credit unions in British Columbia, but like the mighty Douglas firs and the lively communities that define our region, it started off very small with just a seed of an idea.

Take a scroll with us through the decades, and discover how BlueShore’s strong commitment to clients and the community have always been a cornerstone of our story and our values.

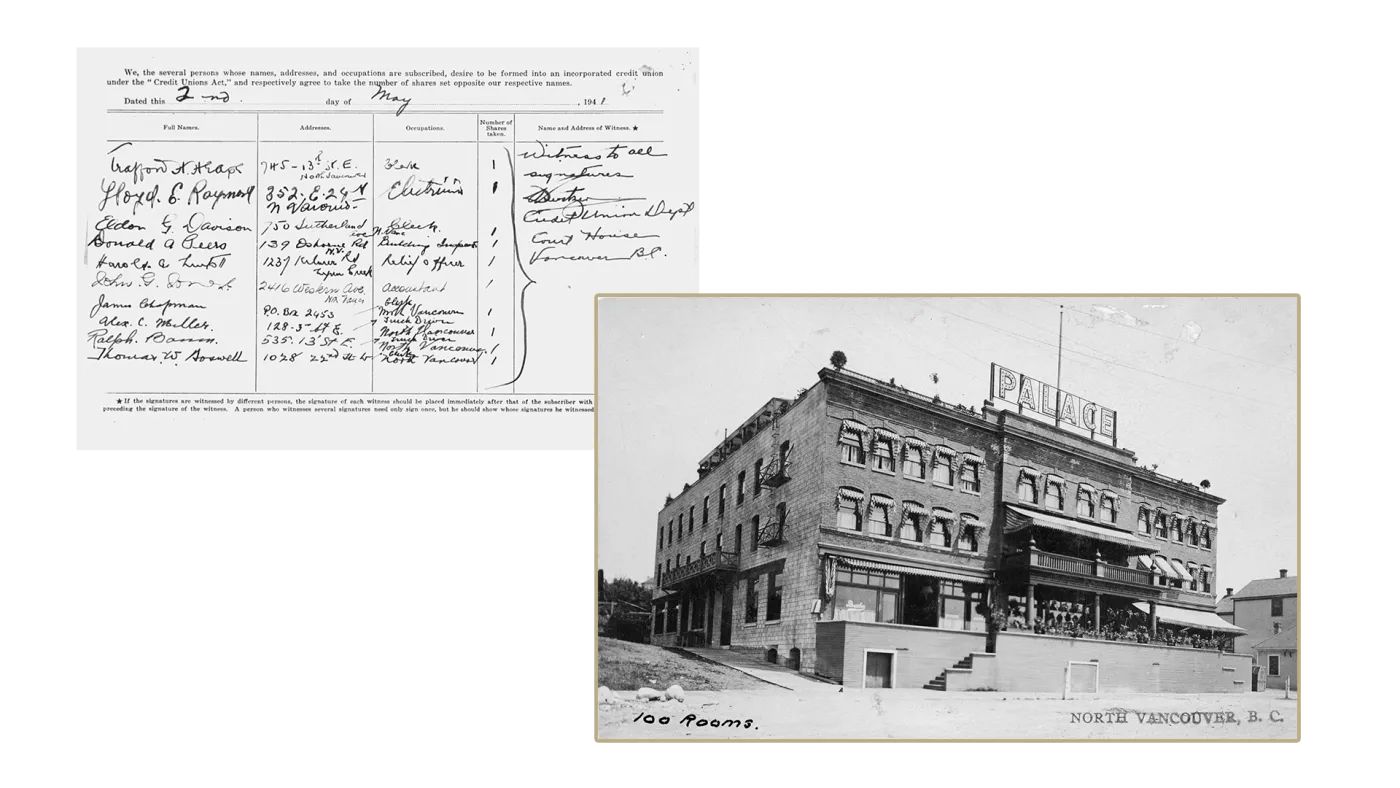

The 1940s: A credit union takes root

Faced with few financial options for blue collar workers in the midst of a world war, nine North Shore residents decided to start their own cooperative credit union. On May 2, 1941, those nine individuals brought $1 each and gathered at the Palace Hotel to sign the charter for North Shore Community Credit Union, today known as BlueShore Financial.

But the BC Inspector of Credit Unions almost prevented it from happening as a minimum of 10 people were needed to found a credit union. So, one of the founders ran home to grab his neighbour, who arrived in a housecoat and slippers, with $1 in his hand to sign the charter. Thus with $10 in capital, the North Shore Community Credit Union was born and incorporated on May 7, 1941 – eventually growing and evolving through the years to become today’s BlueShore Financial.

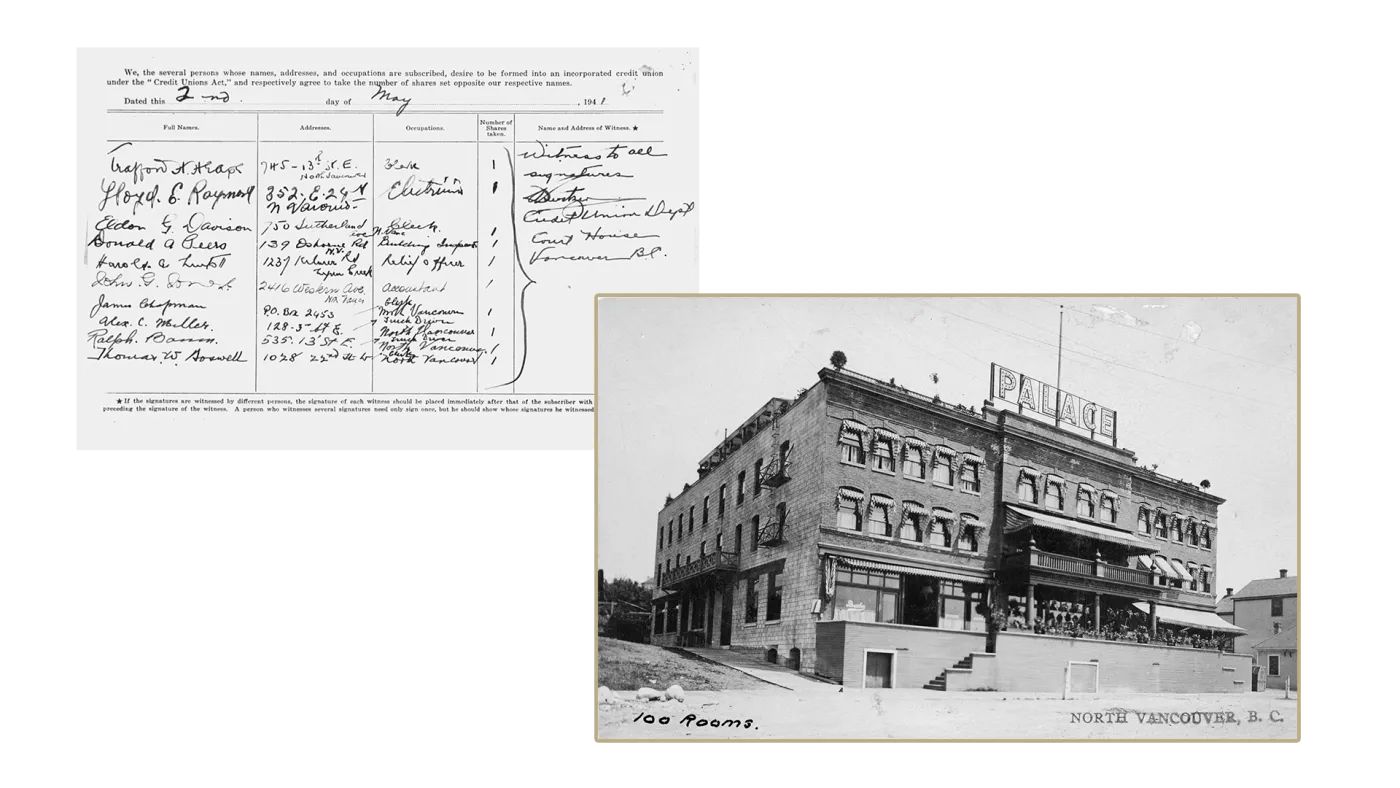

The 1950s: New growth brings new opportunities

With the war over, a baby boom was in full swing and the North Shore was about to boom as well. Developers in North Vancouver created new sub-divisions, such as Capilano-Highlands and Norgate, to attract young families. Shopping centres such as Edgemont Village and Park Royal were founded.

At North Shore Community Credit Union, membership continued to grow at a steady pace, to reach several thousand by the end of the decade. Operation of the credit union moved from the basement of our first president, Tom Dearlove, to a small office at 1323 Lonsdale in 1953. Five years later, we built and moved into our first official Head Office at 1100 Lonsdale in North Vancouver.

The 1960s: Save vs. spend in a tough economy

The economic climate was unsettled. High inflation rates and massive union strikes led many North Shore residents to unemployment. Yet despite this, the City and the District banded together to continue to expand civic infrastructure. They completed several major projects including the Upper Levels Highway, Lions Gate Hospital, both municipal halls, public libraries and community recreation centres.

The unsteady economy meant belt-tightening for many people. North Shore residents were reluctant to borrow money, choosing instead to save what funds they had available. By 1962 North Shore Community Credit Union had over $1 million in shares and $1.5 million in assets. To balance the savings influx with attracting new business and increasing loan activity, North Shore Credit Union began expanding our offerings. We started selling Term Deposits, we partnered with Maple Leaf Travel to provide discount charter flights to members, and we sponsored a financial talk radio show called Voice of Vancouver.

The 1970s: Easier access creates rapid expansion

The infrastructure built in the 60s provided easier access into North Vancouver resulting in a visitor boom. The SeaBus created a third connection between downtown and North Vancouver, and Capilano College (now Capilano University) opened its doors.

The decade was a time of huge growth for North Shore Credit Union. We expanded rapidly by adding branches in Lynn Valley, Marine Drive, Edgemont Village, and Deep Cove. Membership soared from 6,155 to 39,474 members with $150 million in assets. We partnered with two other credit unions to bring the first RRSP products to BC credit unions; created a real estate division; built night depository services; and became the first credit union to own our own insurance subsidiary (NORCU Insurance Services Ltd).

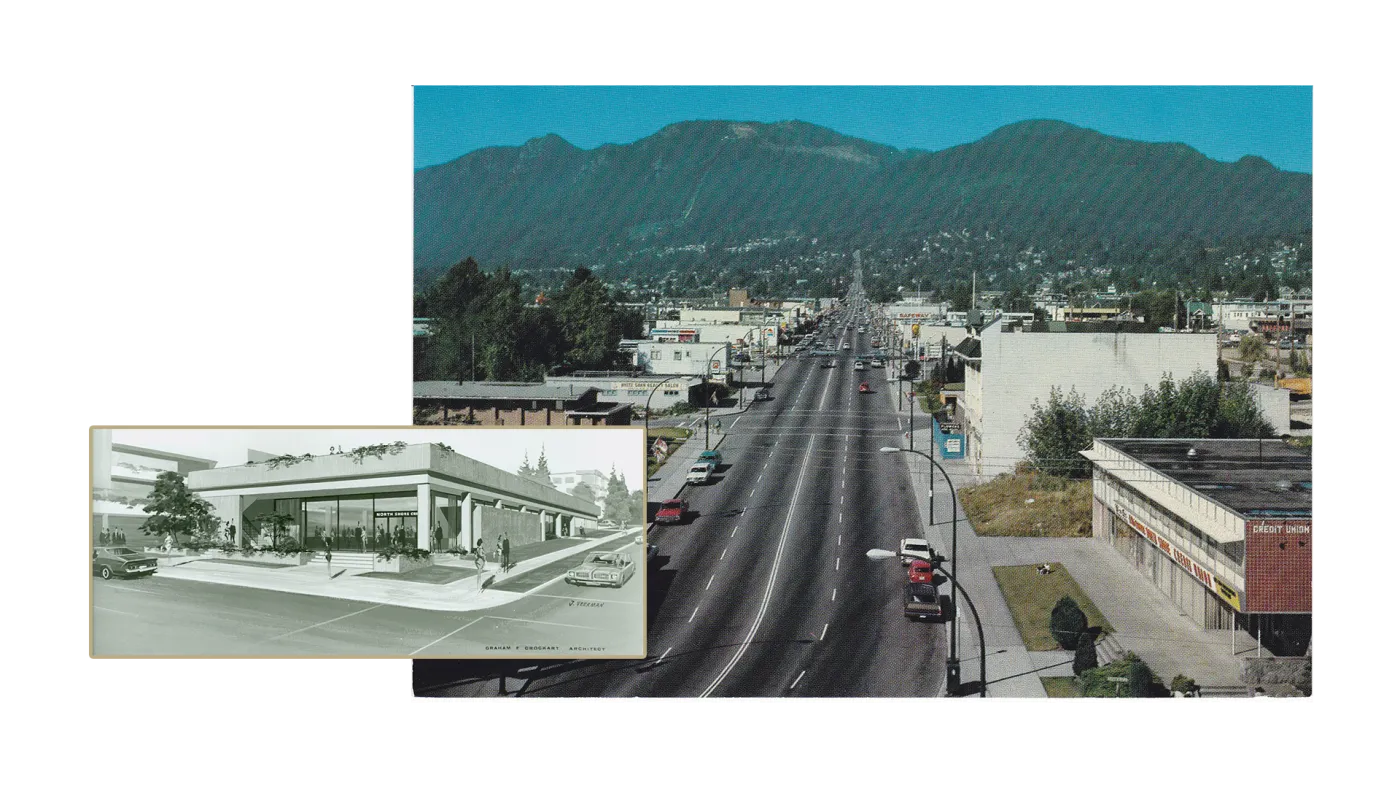

The 1980s: Sparks of technology at the credit union

The declines in demand for shipbuilding, forestry and mining led to drastic cuts in industrial employment. But for the first time, large-scale unemployment wasn’t a concern for North Shore residents. The creation of Lions Gate Film Studios and other studios brought Hollywood north, and with it a boom in technology, design, and engineering jobs. It also brought international attention to the area, which, in combination with Expo '86, resulted in another population boom from an influx of immigration.

As the decade unfolded, new technologies were being embraced by North Shore Community Credit Union. In 1980 we installed the first Automated Teller Machine (ATM) in BC at our Lonsdale branch, and soon expanded our ATM network across all of our branches. We installed computers in every branch, allowing more efficient and automated customer service. We became the first financial institution to open a branch in Whistler and also opened a branch at Park Royal. In 1986 we merged with Harbour Savings Credit Union to acquire two downtown locations (later consolidated into one) and a branch in North Burnaby. We ended the decade with $315 million in assets, 36,000 members, and over 100 sponsored community events and charities.

The 1990s: Entering the Information Age

The 90s was a decade of social transition. Both current and migrating residents were becoming more educated and much wealthier. As the demand for industrial work began to decline, new specialized industries began to expand. Tourism also continued to flourish. Whistler grew into an internationally recognized luxury retreat, while Greater Vancouver became known for its active and multi-cultural communities.

As our membership became more sophisticated, so did we. We dropped "Community" from our name, and coined the "Partners in your Community” slogan. We expanded our service in the Sea-to-Sky Corridor with a branch in Pemberton. We also began customizing the member experience by developing our Relationship Banking approach. We created a “Let’s Talk” campaign to give members their first one-on-one financial planning solution. By 1991, every teller had a personal computer with state-of-the-art technology. We introduced telephone banking and Solution Centre service for member convenience as well as our first Access Card and MasterCard® products.

The 2000s: A new millennium, a new approach

The Vancouver area entered the new millennium with bright hopes and expectations. The already popular Vancouver real estate market became red-hot and it quickly evolved into one of the most expensive Canadian cities to buy into. The Sea-to-Sky highway was rebuilt and expanded to ease passage along the corridor. And the first rapid transit system connecting the airport to the downtown core was completed.

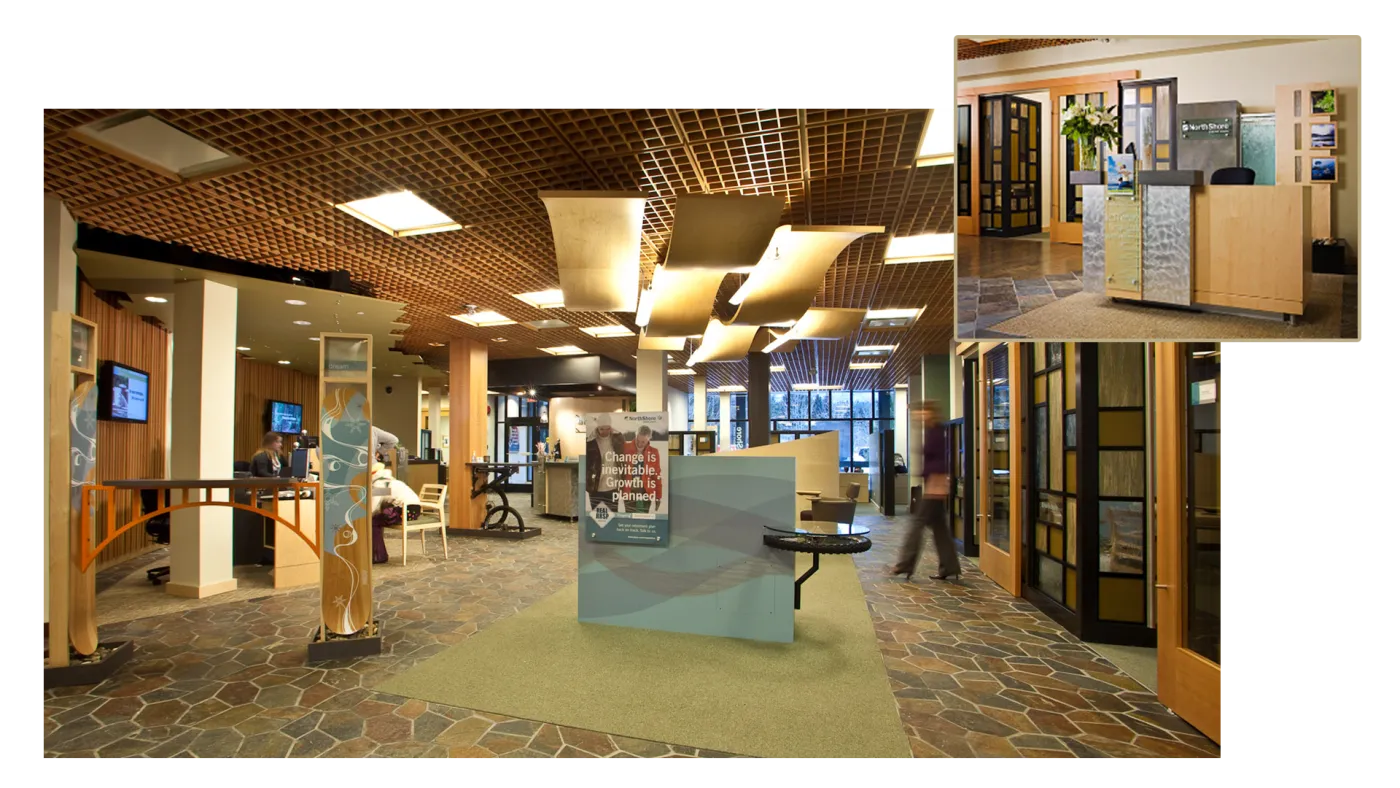

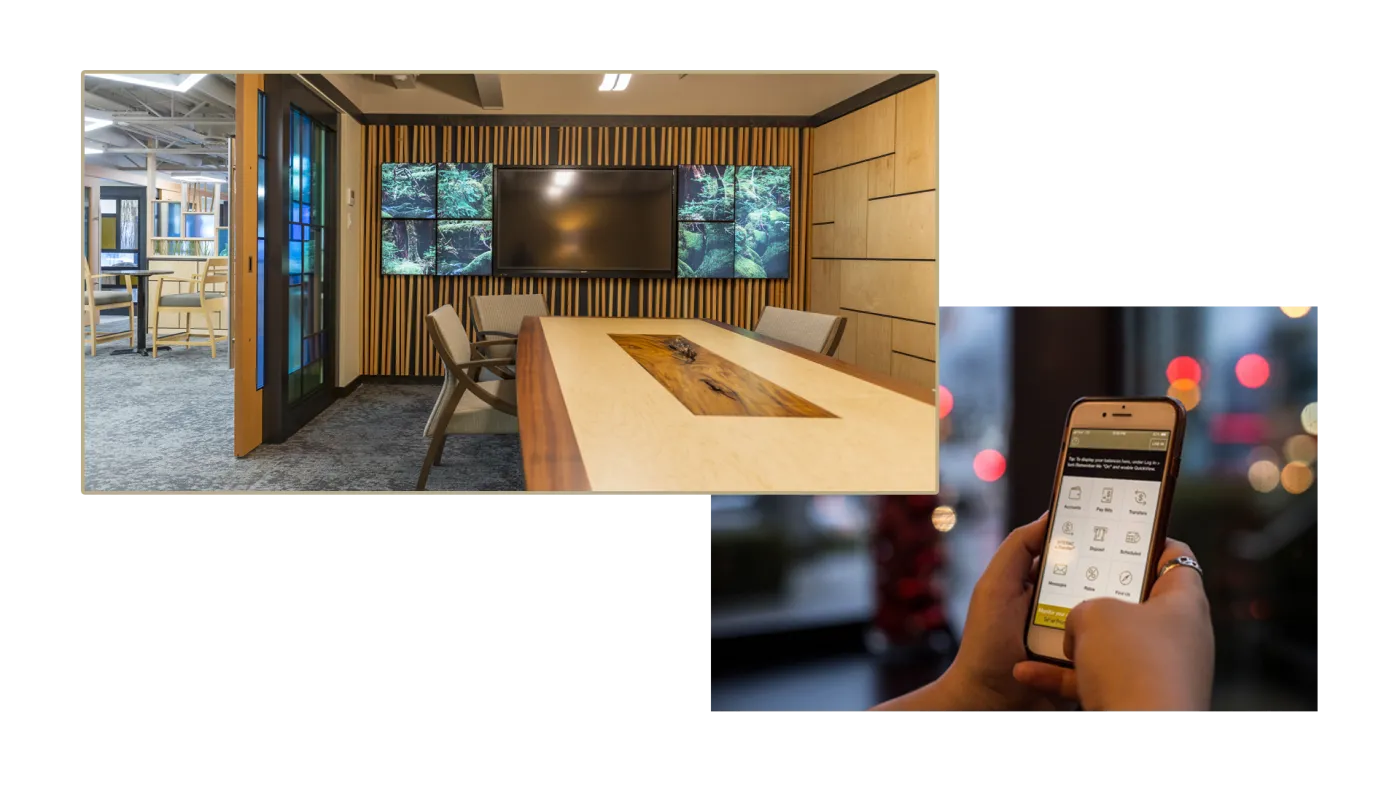

Our increasing focus on relationship banking firmly took hold in 2000 when a new CEO, Chris Catliff, took the helm. We had a vision of a sophisticated banking experience for the affluent market in our trade areas where ensuring the financial well-being of our clients became our primary goal. We also expanded our branch network further, opening a location in Squamish. We adopted our first customer relationship management program that allowed us to keep track of vital client information in one central location. By the end of the decade our innovative Financial Spa® branches had earned us international acclaim; we continued to trail blaze technology solutions; and our upscale yet flexible approach to financial expertise helped our assets soar from $750 million in 2000 to $2 billion in 2010.

The 2010s: New name, same values

The decade opened with the 2010 Winter Olympics, bringing the world’s eyes to Vancouver once more. Neighbourhoods across Greater Vancouver and up the Sea-to-Sky corridor rose to the occasion with gusto. Foreign investment and real estate strengthened and confidence in the city soared high. Infrastructure continued to be improved with the opening of the new Port Mann Bridge, the expansion of Highway 1, and the Evergreen rapid transit line into the Tri-Cities.

In 2013, the credit union went through its own transformation, adopting our current operating name, BlueShore Financial. All part of a long-range plan to build a healthy and sustainable organization, the name change was followed up the next year by the opening of the new custom-built BlueShore Financial head office and Lonsdale Financial Spa in the heart of central Lonsdale, North Vancouver.

From 2010 to 2020, BlueShore achieved many prestigious accomplishments including being named one of the 50 Best Small and Medium Employers in Canada and receiving the Waterstone “Canada’s 10 Most Admired Corporate Cultures” award. Our Financial Spa concept and our innovative technologies continued to earn us international awards and accolades. And our growth across Greater Vancouver solidified, with a West Broadway branch opening in 2011 and our 13th branch in the vibrant Kerrisdale community, opening in 2018.

The 2020s: Agility and transformation

In 2021, BlueShore celebrated 80 years as a key provider of financial services to British Columbians. Building on more than 45 years in the Lynn Valley community, in 2022 we relocated our Lynn Valley branch. The revitalized Financial Spa offers five-star service in a calming environment featuring natural elements of the West Coast, local art, fresh flowers, and music.

Ian Thomas joined BlueShore Financial as our new President and CEO in November 2023, with a vision to grow and strengthen the credit union. In 2024, he spearheaded an opportunity for BlueShore Financial to join Beem Credit Union in its quest to become the premier financial institution in the province. In December 2024, BlueShore members and shareholders voted in favour the merger.

Mid-decade, we marked a significant milestone in BlueShore Financial’s journey as on January 1, 2025, we became a division of Beem Credit Union, creating the second-largest provincially regulated credit union, with the largest branch network in BC. With more than 65 branches, along with insurance offices, the combined organization serves more than 190,000 members across Greater Vancouver, the Sea-to-Sky Corridor, the Fraser Valley, the Interior, and Northern BC.

This merger strengthens our ability to support members, employees, and communities, positioning us for continued growth and success in an increasingly competitive landscape. Together, we are poised for a bright and promising future as we work toward becoming the most people-first, digital-first credit union in the province.

Have a question? Ask an expert

Ricardo Gerarduzzi Financial AdvisorMutual Funds Investment Specialist

Our team of experienced professionals are here to answer any questions you may have.