Qtrade Guided Portfolios

At BlueShore Financial, we provide access to “robo” or “digital” investing through our Qtrade Guided Portfolios platform for those clients who want a simple, low-cost, online option to build their wealth without spending time selecting, monitoring and rebalancing their investments.

And unlike many robo platforms, ours is a “hybrid” advice model, combining the ease and convenience of robo investment with a dedicated advisor to help you make sure your savings plans stay on track.

Getting started is quick and easy. Let Qtrade Guided Portfolios know how much you would like to invest, and through its online goal-based questionnaire it will help you choose the investment portfolio that matches your needs, timeline and comfort zone for risk.

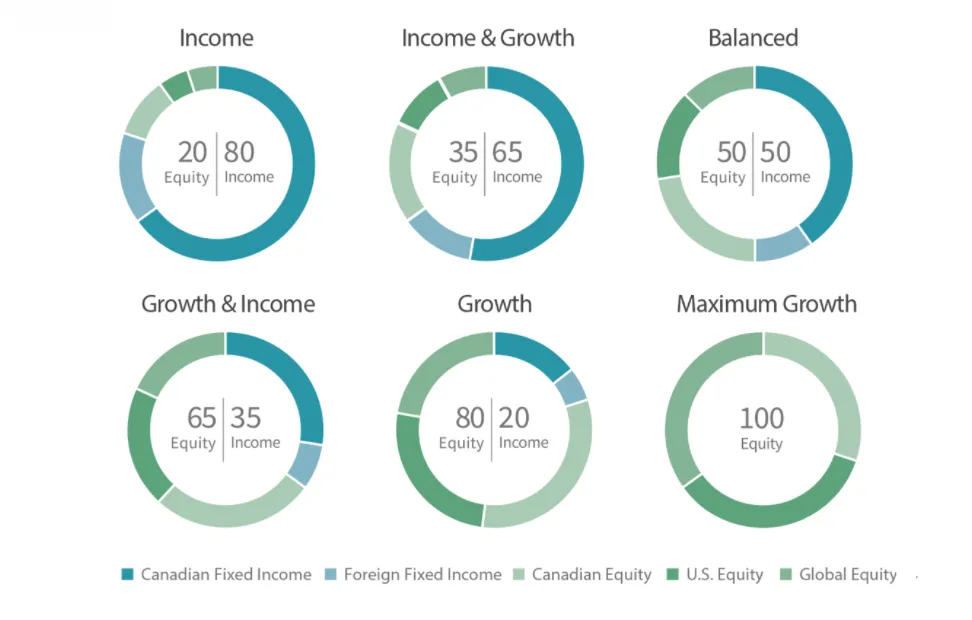

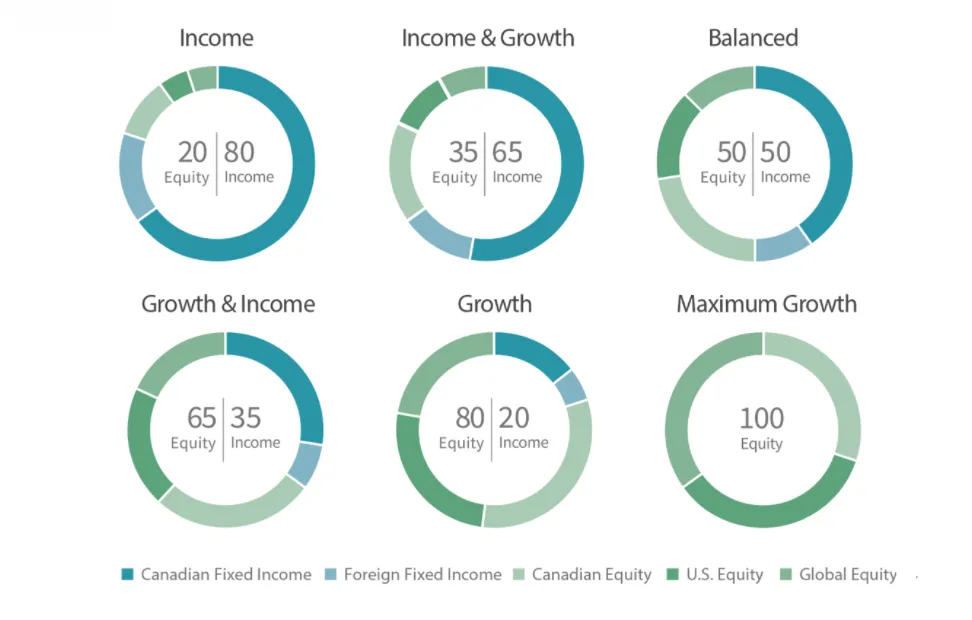

It’s all in the mix

Investing success in large part depends on asset allocation and diversification – holding a strategic mix of investments from different industries and economic regions. With Qtrade Guided Portfolios, your money is invested in Canadian, U.S. and global stocksᶲ and bondsᶲ through the use of ETFsᶲ (exchange-traded funds) or Responsible Investing mutual fund portfolios.

Both options are low-cost, diversified and efficient investments for your portfolio. Account types include non-registered, TFSA, RRSP, RESP, RRIF and more.

Pay less, save more

With Qtrade Guided Portfolios, you pay a low fee, based on a percentage of your assets, in return for both portfolio management and service (advice). And for non-registered accounts, the fee may be tax deductible (consult your tax specialist). A lower fee means you keep more of your money invested, so you save more and reach your goals faster.

There’s no minimum dollar amount required to open a Qtrade Guided Portfolios account; as soon as your cash balance reaches $2,000 it is automatically invested in the portfolio that is suited to your needs.

Clear insights

Straightforward account information is always available online. You can track your progress, see all account activity, and update your personal information. When you have questions, knowledgeable support from a licensed BlueShore representative is available by phone or email.

When is robo advice the right choice?

As a general rule of thumb, robo-advice services are a good low-cost solution for investors who are starting to build their portfolios. However, digital-only robo solutions do put the onus on investors to make sure they remember to contribute to their investments, increase their contributions over time, and avoid selling low and buying high.

What they don’t provide is financial planning assistance and proactive, expert advice on how to deal with market volatility – so “hybrid” robo investing with the benefit of access to an accredited advisor can educate and guide you to where you want to be with your money, and help to keep you on track to reach your goals.

For those who value a knowledgeable financial partner who is proactive in looking for your interests, building a relationship with an advisor may be the preferred option.

Have a question? Ask an expert

Kelly Gares Investment Advisor

Our team of experienced professionals are here to answer any questions you may have.