Enhanced security for online accounts

2-Step Verification (also known as 2SV or two-factor authentication) provides an extra layer of security and protection for your Online Banking accounts, to bring you safety and peace of mind online.

Why 2-Step Verification?

As a BlueShore Financial client, you are required to set up 2-Step Verification, a digital security practice that adds another layer of protection to your Online Banking experience. In addition to your password, the login process will incorporate the use of text or email verification codes, depending on your preference.

Frequently asked questions

2-Step Verification (2SV) is an added level of online security designed to protect the integrity of your account. With this security feature, there will be times when you will be required to complete two steps to access your Online Banking account: Your login ID and a unique verification code.

Many businesses – including financial institutions, software companies, apps, retailers, and more – have implemented 2SV or similar processes for their client accounts.

Yes. Activation is required for all users, including personal and business accounts, of BlueShore’s app and web Online Banking service.

If you use BlueShore’s mobile banking app, you will also need to refresh the app before setting up your 2-Step Verification.

When you first login to the app or Online Banking, you will see the Enable 2-Step Verification screen and be prompted to register for 2-Step Verification.

- On the login screen enter your Login ID (your Access Card number) and your Online Banking password

- In the “Enable 2-Step Verification screen”, enter a mobile phone number (recommended) or email address and select “Send Code”.

- A verification code will be sent to your chosen method (text or email).

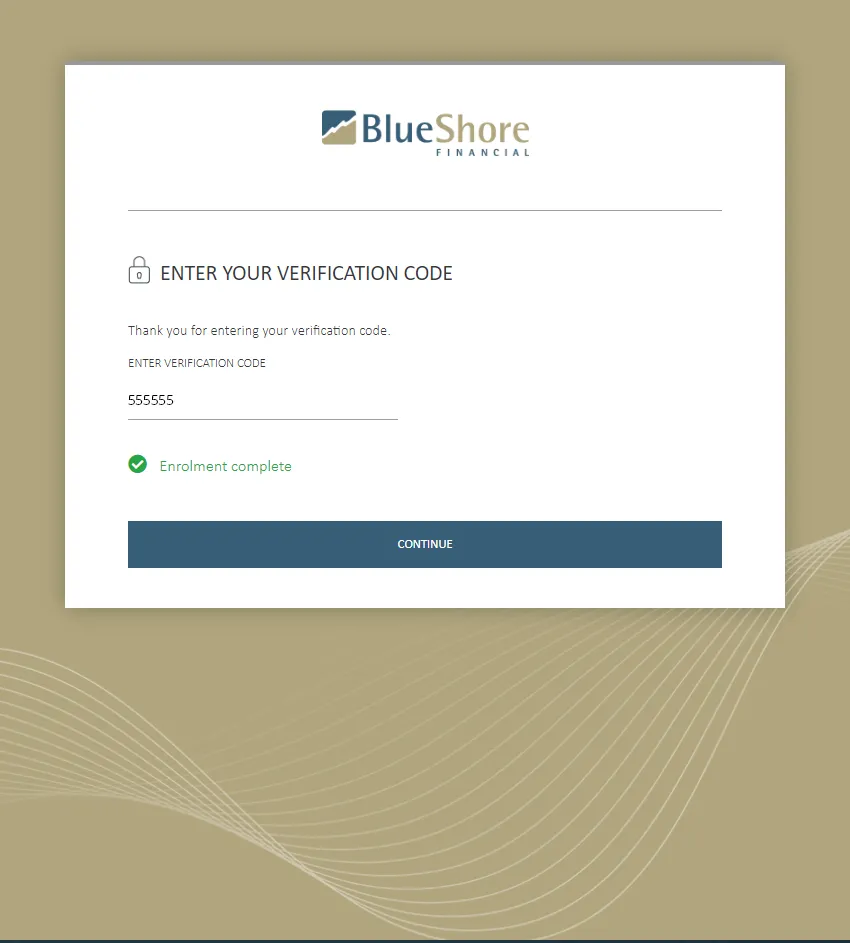

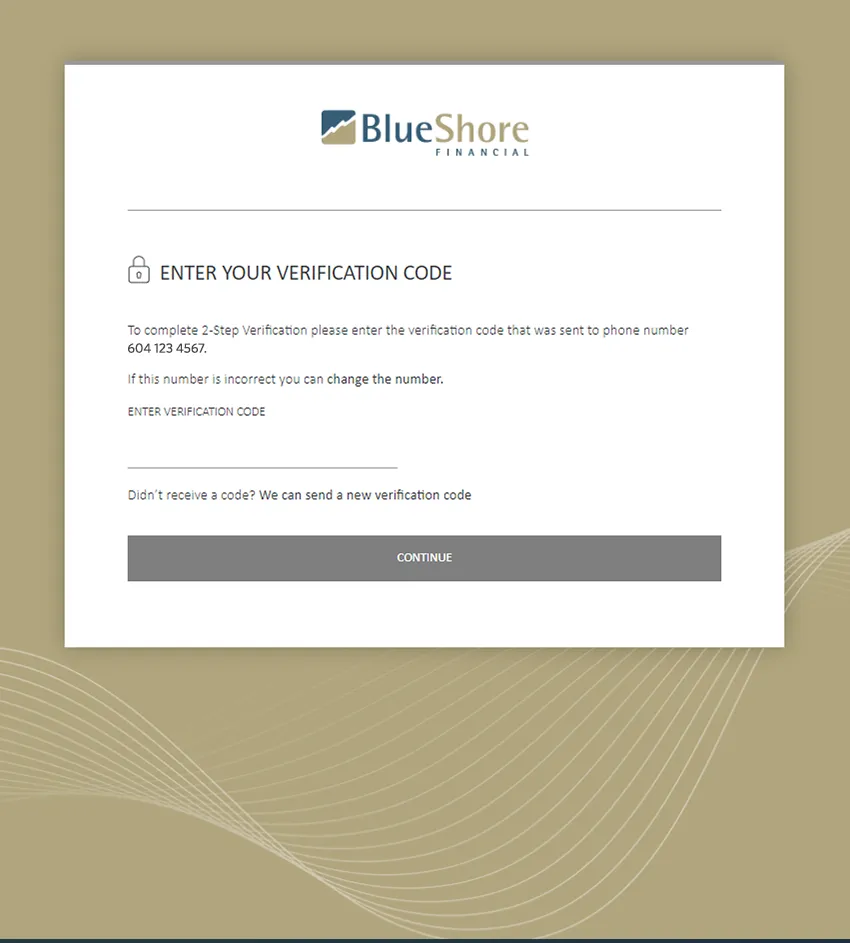

- Enter the code in the “Enter Your Verification Code” screen and select Continue.

A green check mark and the message “Enrollment Complete” will display, and you can now proceed to use your Online Banking.

2-Step Verification in Online Banking is "always on". This means 2SV will be required at every log-in.

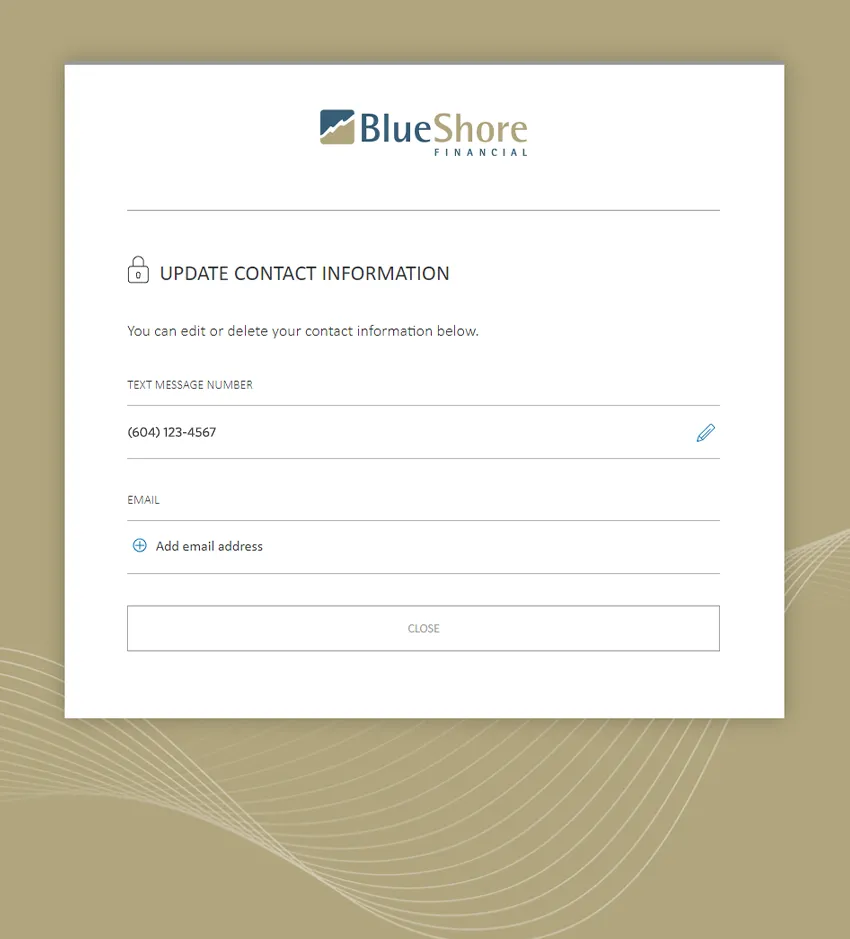

Yes. During your initial enrollment, you can register only one of either a mobile phone number or an email address to receive 2-Step Verification notifications. After that, you can update your contact information from the Profiles and Preferences screen options to add a second notification channel.

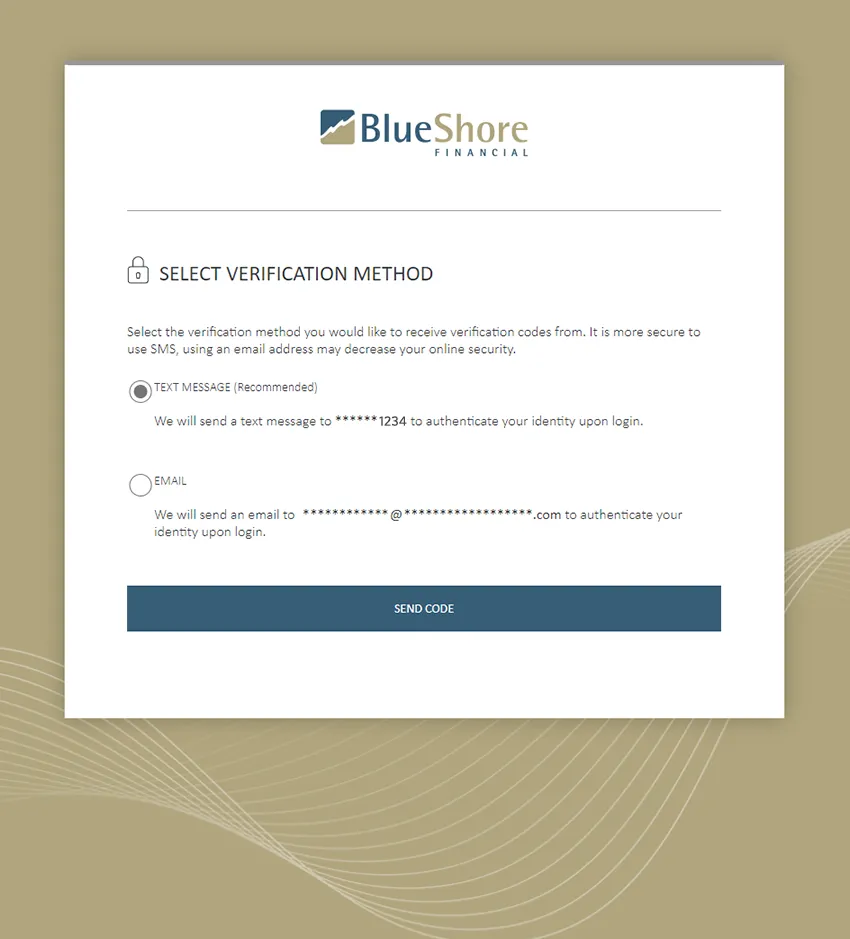

No. During each stepped-up authentication where you have multiple notification channels registered, you will be presented with a Select Verification Method screen where you must select which channel (text/SMS or email) you wish to be notified through.

Our 2-Step Verification process requires only a single mobile phone number and/or a single email registration.

Online login credentials should never be shared. If you would like to grant access to your account to others, such as spouse or business associate, we can help you to set up the account so others can have online access with their own login credentials.

Contact our Solution Centre or visit a branch to discuss the best way to get those who you need online access.

Delegates can still access the account online. Your business delegates will need to enroll 2-Step Verification with their log in as well. They will follow the same process to do this as you, using their existing delegate credentials you created for them, and their own email or phone number to receive the code to. Please communicate this change to your business delegates so they are aware that they will need to enroll.

If a delegate is locked out of the account, BlueShore will not be able to unlock them. To unlock the delegate, please contact the account owner (or signer) to update the Delegate Manager settings.

No.

The maximum attempts to validate a verification code is three.

BlueShore Financial has existing procedures for authenticating clients who have failed authentication. Once you are authenticated, we can unlock your account again.

If this happens to you, call our Solution Centre at 604.982.8000 (toll-free 1.888.713.6728) for assistance.

If this happens to you, visit your nearest branch or call our Solution Centre for assistance. As you won’t be able to receive the 2-Step Verification code notification because it is going to the lost phone, you will need assistance. BlueShore Financial has existing procedures for authenticating clients who have failed authentication. Once you are authenticated, we can help unlock your account for you – but you will be required to re-enroll for 2-Step Verification at your next login.

After waiting a reasonable amount of time for the notification to arrive, you should try re-sending the code using the “send new code” option on the Enter Your Verification Code screen.

In most cases, notifications should arrive almost immediately, but you should wait several minutes before concluding that a notification is not coming. After that amount of time has passed, call our Solution Centre or visit your nearest branch for assistance.

The verification code is valid for 10 minutes from the time it is generated. If you enter and submit after that time, you will receive an error message.

Receiving an SMS text message while out of country may work with some mobile carriers and not with others. In this scenario, you will need to ensure your mobile phone has roaming or set up your account so that your code goes to email instead of your phone while abroad.

There may also be unique scenarios where countries block certain websites or web access as a whole. In those cases, you may have difficulty receiving a code via email if using a blocked provider such as Gmail. In this case, contact our Solution Centre at 604.982.8000 (toll-free 1.888.713.6728) for assistance.

Need more help? Ask us

If you’re not currently registered for Online Banking or require help going with this process, please call us at 604.982.8000 (toll-free 1.888.713.6728) or visit a local branch.